The following excerpts were translated and originally appeared in EEFOCUS.

According to IDC, by 2022, the smart home market is expected to reach 1.3 billion devices, including smart speakers, video entertainment products, connected lights, smart thermostats, and home monitoring/ security products. The five-year compound annual growth rate (CAGR) will be 20.8%.

With many participants in the game, the competitive landscape of the smart home market is not yet clear. Therefore, opportunities exist for all kinds of enterprises. However, with the expansion of the market capacity, the competition will become more and more intense. Requirements for the specialization of enterprises, the response speed of services, and product stability will get higher. Enterprises with better branding, specialization, and scale will have better market prospects.

Although the growth of the smart home market is speeding up, most smart home products are still in the stage of single-product intelligence or single-product connection. The industrial chain is still scattered and relatively slow.

During The Large Outbreak of Smart Home series hosted by EEFOCUS, Lori Lee, senior regional marketing manager of APAC at the Bluetooth Special Interest Group (SIG) said, “At this stage, the lack of a global connectivity standard is the number one obstacle to the development of the smart home industry. In the process of practical applications, it is difficult for home products from different manufacturers and brands to achieve connectivity, and they usually fail to make consumers feel they are intelligent. That is why the consumer penetration rate of these products is still low. Therefore, in the future, only when more smart home manufacturers choose global standards suitable for their own ecological systems, can the smart home market achieve a full-scale outbreak.”

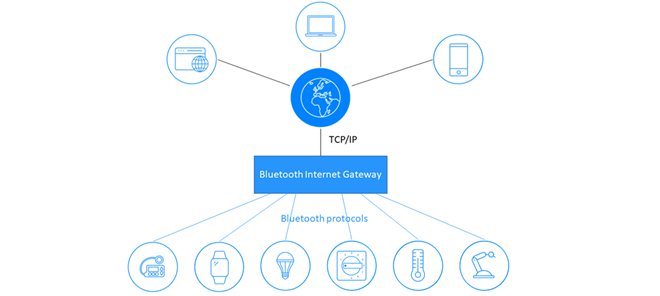

Smart speakers have seen a boom in recent years. Chinese internet giants launched their own smart speakers as the center of their home ecosystem. Sound-control equipment acts as an entrance to smart homes around which a small home network can take form. According to the 2019 Bluetooth® Market Update, all smart speakers are currently using Bluetooth technology. With the support of wireless standards, such as Bluetooth Mesh, it is hoped that more and more home devices will be connected to the network and help create more home applications.

The smart home promises to enable different products to connect and form a communication network, and the ultimate goal is system-level intelligence. Therefore, the most important task in the development of the smart home industry chain is to solve the problem of interoperability between the products of different manufacturers. This is also the biggest challenge in achieving the stage of system-level intelligence. The release of Bluetooth® Mesh can solve this challenge by opening a platform that ensures interoperability between all devices. Moreover, it has expansion ability and high deployment elasticity, which greatly improves the flexibility of smart-device network deployment and provides the soil for the rapid development of the smart home.

Multiple industries are getting involved in smart home systems. Manufacturers are making devices under different interface standards and protocols with no uniform set of industry standards on the market. Over the years, the smart home industry standard has yet to be unified; the interconnection between different devices has been a common problem in the industry. At present, most smart home products are a single-piece existence, and the method of smart home control is basically through mobile phones.

Solving Smart Home Fragmentation and Information Silos

“Interoperability is essential in the world of the IoT, and the market needs a unified standard to drive the rapid development of the home automation market,” said Lee. Now, the interoperability of Bluetooth® Mesh meets the needs of the smart home market. Alibaba, Xiaomi, and other well-known manufacturers made a strategic decision to support Bluetooth Mesh network technology on their smart home development platform. Consumers can be sure that the Bluetooth Mesh products they buy from one supplier will work with other products. At this point, Bluetooth mesh is an important step forward. With its reliability, security, and interoperability, Bluetooth technology will help unlock the full potential of the home automation market.

Earlier this year, the Bluetooth SIG also established a Smart Home Subgroup that is committed to developing Bluetooth Mesh models for the smart home that supports cross-vendor compatibility and interoperability, resulting in more intelligent and integrated smart home solutions.

More and more mainstream smart home product manufacturers are choosing to adopt Bluetooth Mesh as their smart home solution networking protocol. They mainly value the advantages of self-networking, security, ease of use, and the ability to directly connect to mobile phones and devices as well as low-power consumption and cost-effective chipsets. A growing number of manufacturers use Bluetooth® Mesh to develop products that will create a globally connected ecosystem based on uniform standards. The establishment of this subgroup will play an important role in creating more Bluetooth Mesh modules that support the interoperability of home appliances.

Wired vs Wireless Connections

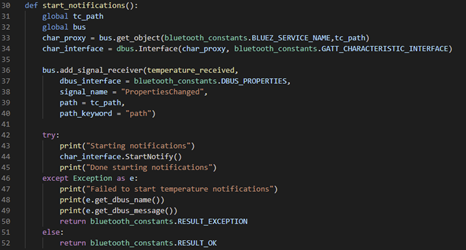

Smart home network connectivity is divided into wired and wireless connections. What factors do businesses consider when choosing a communications protocol? And how do you choose the right communication protocol based on your needs and scenarios? What is the trend of future smart home industry communication protocols? These are the problems in front of industry manufacturers.

Lee pointed out that both wired and wireless technologies have their advantages and disadvantages. The advantages of a wired connection are the high data-transfer rate, no environmental restrictions, and strong anti-jamming capabilities. The disadvantages are long maintenance and construction cycle, high construction costs, poor system flexibility, and so on. On the other hand, wireless smart home system maintenance is simple, it can quickly detect and repair the problem, installation is easy, it requires no complex wiring, it supports automatic networking, and the equipment has better expansion capabilities.

When choosing wireless communication protocols, the main considerations of enterprises include security, stability, cost, and connectivity. Each wireless protocol has unique features and characteristics, and choosing the right protocol depends on the specific needs and application scenario of the final product. In the case of Bluetooth® wireless technology as the mainstream wireless communication protocol in today’s smart home systems, Bluetooth Mesh provides reliable, high-performing, and extensible connectivity that greatly increases the flexibility of smart-device network deployment. This enables a better user experience for a wide variety of smart-life scenarios. In addition, Bluetooth technology is widely trusted and widely used around the world, giving it a competitive edge.

Choosing a unified, high-security communication protocol standard is especially important to reduce the security risk for smart homes. In Bluetooth Mesh, security is mandatory. Networks, apps, and devices must all be secure. The reliability of a Bluetooth Mesh network depends on the ability to deliver information from one device to another. It uses peer-to-peer communication and multi-channel information relay to ensure that information transmission is not disturbed. As a result, Bluetooth networks can easily automate homes while providing industrial-grade security and reliability for residential applications.

Earlier this year, the Bluetooth SIG released the 2019 Bluetooth® Market Update. This report is supported by ABI Research and several other analyst organizations. It makes a predictive analysis of the development of the smart home market and comes up with the following points.

- Connected home devices exceed home automation by more than 3:1 — Bluetooth technology has been an integral part of the home for years. Even with home automation exceeding 21% CAGR through the next five years, annual shipments of connected home devices like tools, toys, gaming systems, and TVs will approach 900 million by 2023.

- Major ecosystems are defining the home automation conversation — Major technology player ecosystems will drive the home automation market through the forecast period. This past year, leading companies like Alibaba and Xiaomi strategically chose Bluetooth® technology to help define their home automation experience.

- Smart appliances is the fastest growing home automation device category — While smart lighting is expected to see 4.5x growth, smart appliances show the strongest potential with a 59% CAGR over the next five years – reaching 54 million devices shipped each year by 2023.

According to a survey from Qianzhan Industry Research Institute, Chinese consumer’s perception of the smart home is still in a vague stage. At present, the domestic smart home field lacks unified standards, and products developed by different enterprises lack interconnection and interoperability, which is not conducive to market development. In the future, the adoption of technical standards can not only effectively reduce costs, but it can also improve the interoperability of equipment between different manufacturers, which will help expand the market. At the same time, coupled with local smart home manufacturers planned to carry out market education and promotion, it is believed that the smart home penetration rate will steadily increase.

The Bluetooth SIG Smart home Subgroup will continue to invest in mesh model development to achieve cross-manufacturer interoperability in the smart home sector. This will promote significant growth and innovation in the field of home automation in the next few years.

![]()

![2312 CES Handout Images FINAL existing pdf 464x600[1]](https://www.bluetooth.com/wp-content/uploads/2024/01/2312_CES_Handout-Images_FINAL-existing-pdf-464x6001-1.jpg)