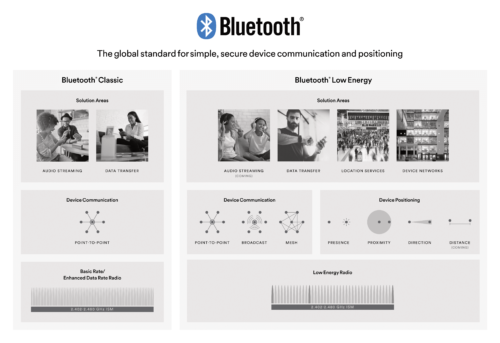

For years, Bluetooth® technology has been, and still is, synonymous with audio streaming; so much so that, according to this year’s Bluetooth Market Update, 9 out of 10 speakers will include Bluetooth technology by 2023. The market transition to wireless speakers is nearly complete, confirming consumer confidence in and preference for Bluetooth wireless audio. But as the Bluetooth community expanded the capabilities of the technology, Bluetooth solutions started being featured across more and more markets. Now, every year, millions of Bluetooth low-power devices — from fitness trackers and health & wellness monitors to toys and tools — free consumers from the tether of wires.

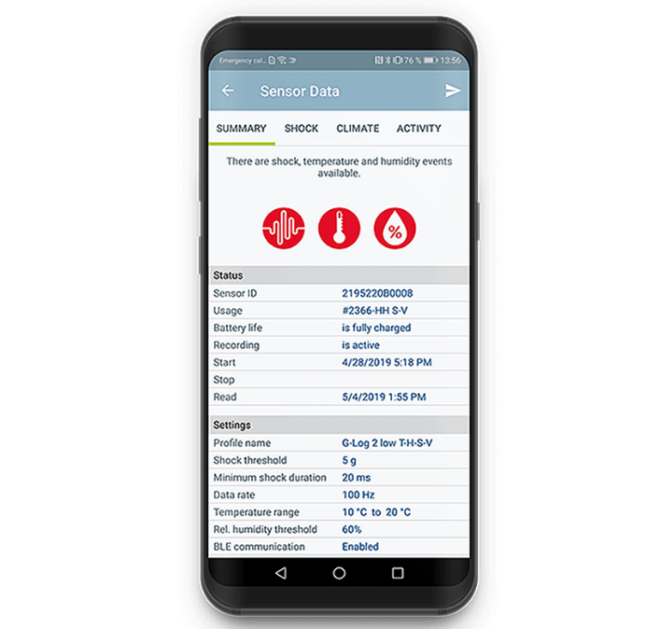

The wide application of Bluetooth technology shows us that anything can be a connected device. According to the 2019 Bluetooth Market Update, simple data transfer solutions are forecasted to double from 690 million shipped annually in 2018 to 1.3 billion annual shipments in 2023. This means that, by the end of the forecast period, data transfer will be the leading Bluetooth solution area by annual volume.

Anything Can Be a Connected Device

“Bluetooth® Low Energy has made it easy for developers to implement applications and data collection functions from any device.”

Considering that Bluetooth® technology is integrated in 100 percent of phones, tablets, and PCs, the ubiquity of the technology makes it that much easier for developers to implement it into their connected device innovations. “It’s all about the proliferation of Bluetooth Low Energy and the concept that anything can be a connected device,” said Chuck Sabin, Bluetooth SIG senior director of strategy and planning. “Bluetooth Low Energy has made it easy for developers to implement applications and data collection functions from any device.”

The ability to collect data and turn it into information is an added benefit that can be incorporated in any device — whether it’s a cup, scale, toothbrush, or light bulb. “To a degree, it doesn’t have to be a purchase decision that an individual has to make about that product,” said Sabin. “Consumers buy a product for the function of that product, and the ability to collect data around that function is an added feature. The simplicity of a developer being able to add a data collection capability to any device is what’s proliferating sharp growth in data transfer solutions.”

Beyond Classification

A byproduct of data transfer device proliferation has been a high volume of unclassified, long-tail devices. Shortly after its inception, Bluetooth® technology only catered to a handful of well-defined device categories (cars, speakers, headsets, mice, keyboards, etc.). With the emergence of Bluetooth Low Energy, the ceiling for what defined a single device category was shattered, and Bluetooth became a technology for every device.

Unlike most solution areas, data transfer is not dominated by a particular device type. With audio, for example, the headset is far and away the highest volume single device category. But data transfer solutions are a long tail of varying device types. Many of the chips and modules being sold into the data transfer market cannot yet be classified into a device category. This creates an other consumer electronics devices category that currently accounts for 11 percent of the overall connected devices market.

Sharp Market Growth

The concept of including Bluetooth® technology as an added feature in all sorts of devices continues to play out in the market place. There’s always data to be collected, and recent trends indicate that the growing demand for data collection — for the purpose of turning it into information and action by the individual or organization — is the main driver for the increase in the volume of data transfer devices.

For more on what analysts are predicting within Bluetooth solution areas and markets, download the 2019 Bluetooth Market Update.