2023 Bluetooth® Market Update

A Letter from the CEO

The Bluetooth SIG member community is dedicated to delivering innovations that improve the capabilities of Bluetooth® technology and help shape new market trends. From wireless audio and wearable devices to asset tracking and electronic shelf label solutions, Bluetooth SIG member companies continue to meet the needs of consumer, commercial, and industrial use cases.

Thanks to the hard work of everyone involved, Auracast™ broadcast audio was announced last year and is already impacting market trends. This new Bluetooth capability lets consumers share their audio, unmute their world and hear their best, in public and private settings.

The updated 2023 Bluetooth® Market Update includes a first look at the forecast for LE Audio, Auracast™ deployments, and the transition from Bluetooth Classic Audio to LE Audio. The report also looks at new, high-volume markets, such as electronic shelf labels (ESL) and Ambient IoT. We are excited to see how these markets develop.

Forecasts in the 2023 Bluetooth® Market Update reflect the tireless work of the many Bluetooth SIG members who are developing innovations that create a more connected world.

It is an honor to be part of such an incredible community.

Mark Powell | CEO | Bluetooth SIG, Inc.

Supported by updated forecasts from ABI Research and insights from several other analyst firms, the Bluetooth® Market Update is intended to help global Internet of Things (IoT) decision makers stay up to date on the role Bluetooth technology can play in their technical roadmaps and markets.

Supported by updated forecasts from ABI Research and insights from several other analyst firms, the Bluetooth® Market Update is intended to help global Internet of Things (IoT) decision makers stay up to date on the role Bluetooth technology can play in their technical roadmaps and markets.

Unless otherwise noted, stats without a specified source are from ABI Research. Data files referenced from ABI Research include Bluetooth Data Set (4Q22), Wireless Connectivity (1Q23), Mobile Accessories and Wearables (1Q23), Indoor Positioning and RTLS (1Q23), Smart Home Hardware (4Q22), 6G Ambient IoT Opportunity for Supply Chain (4Q22), and Condition-based Monitoring IoT (4Q22).

Bluetooth®

Total Shipments

Annual Device Shipments

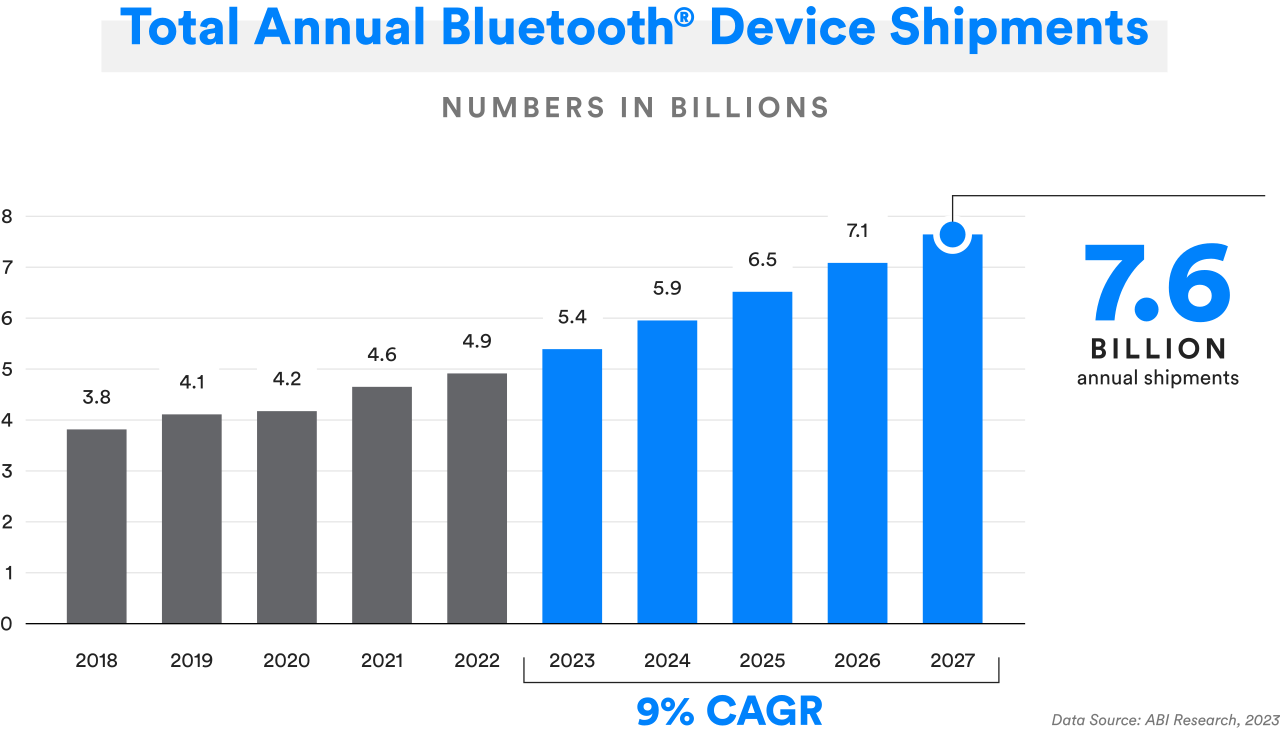

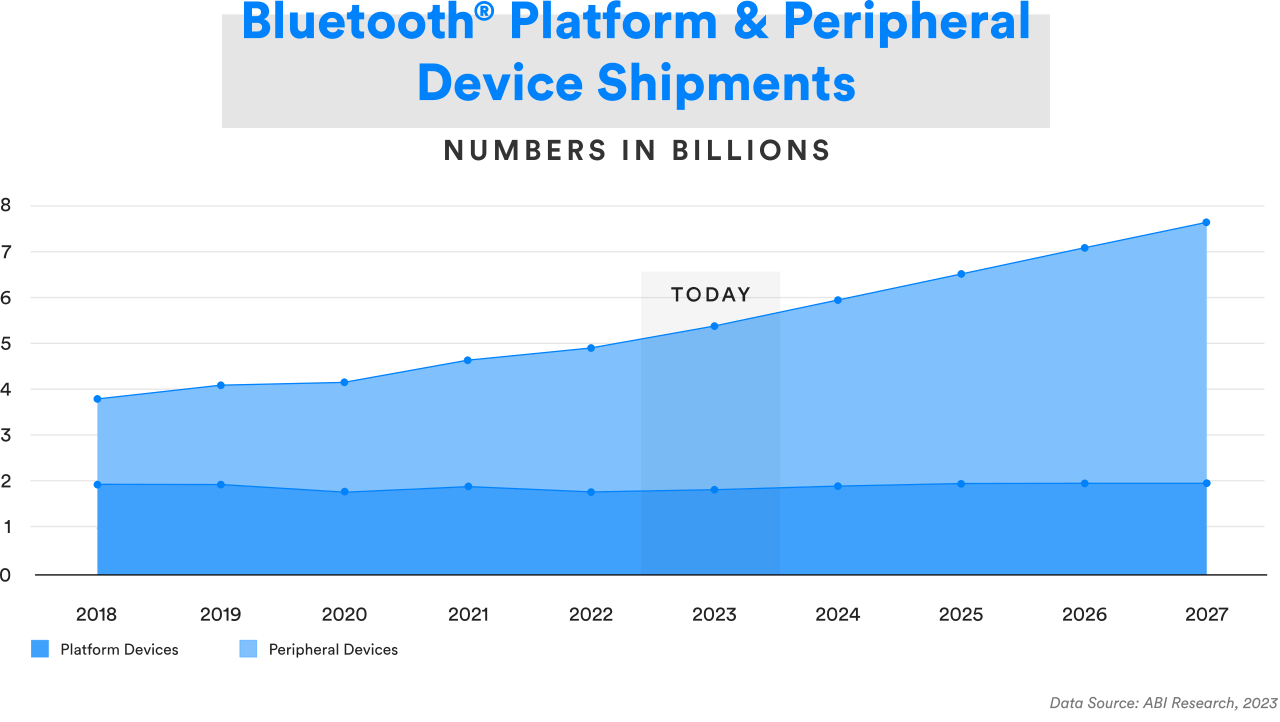

Total number of devices shipped will follow a steady incline

The pandemic proved to be a turbulent time for many global markets with COVID-19 impacting supply chains and creating noticeable short-term shipment shortfalls for certain device types, such as smartphones, asset trackers, and voice-controlled front ends. While near-term forecasts are slightly down from last year, analysts anticipate higher growth over the later half of the five-year forecast. By 2027, 7.6 billion Bluetooth enabled devices will be shipping annually, representing a nine percent compound annual growth rate (CAGR) over the next five years.

Total Shipments

Shipments by Radio

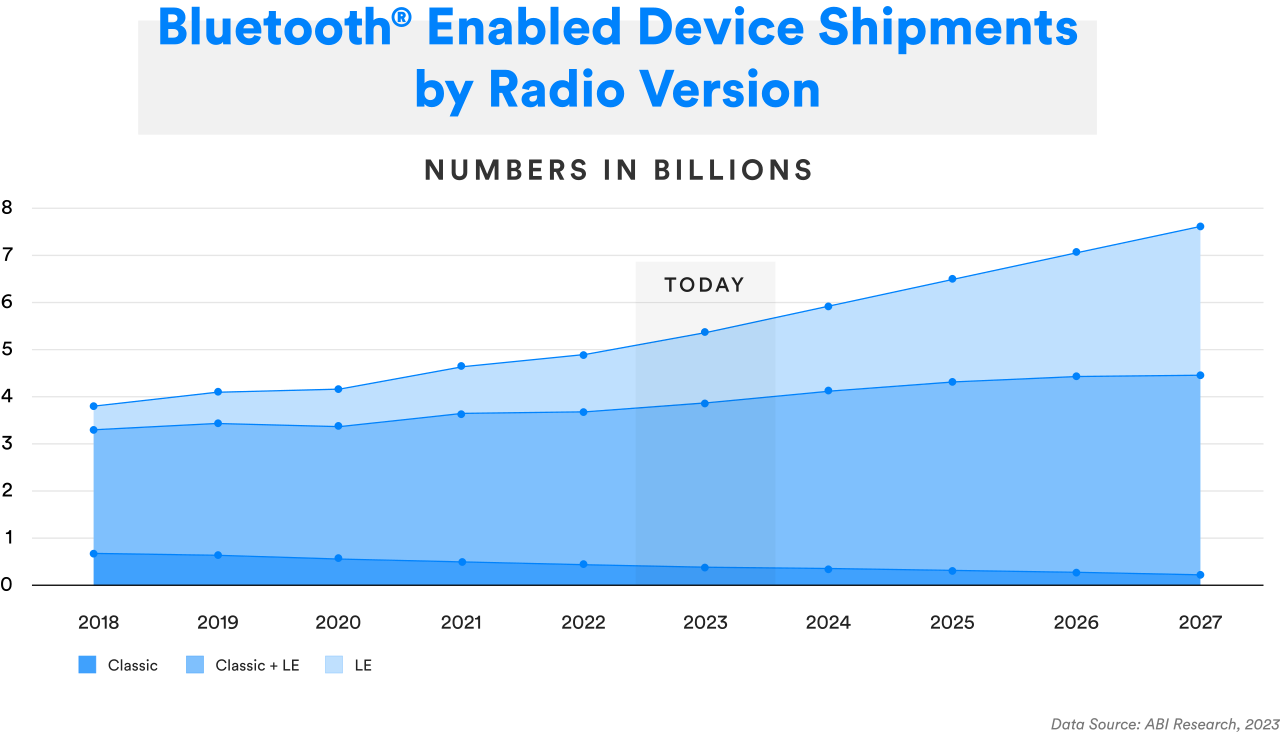

Bluetooth® technology supports multiple radio options, allowing developers to build products that meet the unique connectivity needs of their customers.

Today, Bluetooth Classic and Bluetooth Low Energy (LE) radios are included in all traditional platform devices, from smartphones to tablets to laptops. Bluetooth dual-mode operation (Bluetooth Classic + Bluetooth LE) is now becoming standard in additional platform devices like TVs. Because of this, most Bluetooth devices shipped over the last five years have been and will continue to be dual-mode devices. Furthermore, many audio devices, such as earbuds, are also shifting to dual-mode operation.

Due to the ongoing strong growth of connected consumer electronics devices, combined with the recent release of LE Audio, peripherals will continue to drive the growth of single-mode Bluetooth LE device shipments. Annual shipments of single-mode Bluetooth® LE devices will nearly match those of dual-mode annual device shipments by 2027.

1.5 BILLION

1.5 BILLION

Bluetooth® LE single-mode devices will ship in 2023

Peripherals drive single-mode Bluetooth® LE device growth

Driven by continued strong growth in peripheral devices, Bluetooth® LE single-mode device shipments are forecasted to more than double over the next five years. In addition, when you consider both single-mode LE and dual-mode Classic + LE devices, 97 percent of all Bluetooth devices will include Bluetooth LE by 2027.

100%

of key new platform devices support dual mode (Bluetooth® Classic + Bluetooth LE)

All platform devices support Bluetooth® Classic and Bluetooth LE

Developers can count on Bluetooth® Classic and Bluetooth LE to be in all platform devices. With Bluetooth LE and Bluetooth Classic in 100 percent of phones, tablets, and PCs, the number of dual-mode devices supported by Bluetooth technology is reaching complete market saturation.

3.5 BILLION

3.5 BILLION

Bluetooth® peripheral devices will ship in 2023, growing to 5.6 billion in 2027

Peripherals will continue to drive the growth of Bluetooth® device shipments

Since all smartphones, tablets, and PCs support Bluetooth® LE, the growth rate of Bluetooth technology in peripheral devices will continue to outpace platform device growth. Bluetooth peripheral device shipments are set to double platform devices shipments in 2023.

Feature Enhancements

The Bluetooth SIG member community continues to expand the capabilities of Bluetooth® technology — powering innovation, creating new markets, and redefining what is possible in wireless communication. The hard work and collaboration between our member companies drive continuous innovation. Typically, there are more than 50 active specification projects in process. Here are some of the major Bluetooth specification projects recently completed or currently underway.

RELEASED

LE Audio

Building on 20 years of innovation, LE Audio enhances the performance of Bluetooth® audio, adds support for hearing aids, and enables Auracast™ broadcast audio, an innovative new Bluetooth capability with the potential to, once again, change the way we experience audio and connect with the world around us.

RELEASED

Periodic Advertising with Responses

Bluetooth® Low Energy (LE) supports multiple logical data transport options designed to satisfy a wide variety of device communication needs. The Periodic Advertising with Responses (PAwR) feature defines a new Bluetooth LE logical transport designed to support several new device communication scenarios, including situations in which a hub needs to maintain bi-directional communication with thousands of end nodes. One key use case for PAwR is the rapidly growing electronic shelf label (ESL) market, which until now lacked a global standard for wireless ESL.

UPCOMING

High-Accuracy Distance Measurement

Adding to the growing set of device positioning capabilities of Bluetooth® wireless technology – which currently includes advertising (for presence), RSSI (for basic distance measurement), and direction finding (for high accuracy direction) – a specification development project is currently underway to enable high-accuracy distance measurement between two Bluetooth enabled devices. This feature is expected to enable the creation of locating systems that can provide even higher levels of accuracy.

UPCOMING

Higher Data Throughput

The LE 2M PHY was introduced to address a number of market opportunities, including enhancing data transfer performance for the growing number of IoT devices consumers were connecting to their smartphones. Today, an increasing number of these connected devices are looking for even greater performance, as well as support for streaming larger media, and could benefit from an even higher data rate Bluetooth® LE PHY. The Higher Data Throughput project was established to address that growing market need and intends to support data rates up to 8 Mbps.

UPCOMING

Bluetooth® LE in Higher Frequency Bands

A specification development project is currently underway to define the operation of Bluetooth® Low Energy (LE) in additional unlicensed mid-band spectrum, including the 6 GHz frequency band. The new spectrum expansion project will help ensure that Bluetooth performance enhancements, including higher data throughput, lower latency, greater positioning accuracy, and new capabilities will continue to meet the future needs of companies implementing Bluetooth technology into their devices and solutions.

Emerging Use Cases

As the Bluetooth SIG member community continues to develop innovative features and capabilities, Bluetooth® technology is being used to not only power more and more traditional use cases, but is also expanding into and creating a wide range of emerging use cases.

AuracastTM Broadcast Audio

AuracastTM broadcast audio is a new Bluetooth® capability that will deliver life-changing audio experiences. It will let you share your audio, unmute your world, and hear your best, enhancing the way you engage with others and the world around you.

Digital Key

As the smartphone continues to expand its role in everyday life, Bluetooth® technology is enabling smartphones to be used as a convenient and secure digital key, unlocking and controlling your car, or securely accessing your home, office, and more.

Electronic Shelf Labels

Electronic shelf labels (ESL) are small, battery-powered electronic ink displays that present product and pricing information at the shelf edge, replacing paper labels. ESLs use wireless technology to communicate with a central hub to form a dynamic pricing and product information network. Bluetooth® ESL helps retailers automate pricing, improve shelf inventory, and enhance the shopper experience.

Networked Lighting Control

Networked lighting control systems feature an intelligent network of individually addressable, sensor-rich luminaires and control devices that allows each component of the system to send and receive data. Bluetooth® networked lighting control systems are deployed in offices, retail, healthcare, factories, and other commercial facilities to deliver a combination of energy savings, enhanced occupant experience, and more efficient building operations.

Ambient IoT

Enabled by a new class of very low-cost Bluetooth® tags that can track an item's current inventory, condition, and state, the Ambient IoT promises to connect and efficiently manage everyday objects that surround us. Initially focused on improving high-velocity supply chains in the food and pharma industries, the Ambient IoT total addressable market is measured in the trillions of units.

Bluetooth®

Solution Areas

Solutions to Meet Market Needs

Bluetooth® technology provides full-stack, fit-for-purpose solutions to meet the ever-expanding needs for wireless connectivity. After first addressing audio streaming, Bluetooth technology has expanded into low-power data transfer, indoor location services, and reliable, large-scale device networks.

Audio Streaming

The audio cable was one of the first cords Bluetooth® technology cut. Stripping away the hassle of wires on headphones, speakers, and more, Bluetooth technology revolutionized audio and has forever changed the way we consume media and experience the world.

Key Use Cases

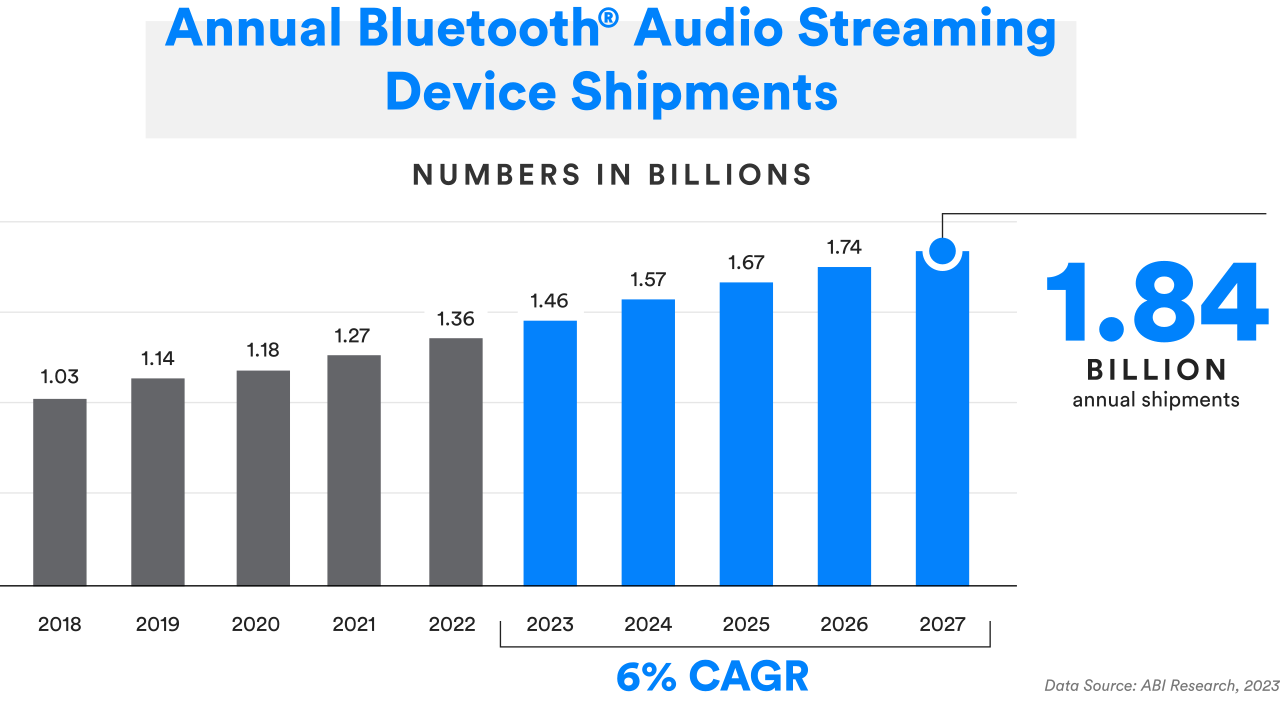

Continued growth in audio streaming device shipments

Bluetooth® audio continues to see linear growth despite post-pandemic challenges and economic slowdown.

1.35x GROWTH

in annual Bluetooth® Audio Streaming device shipments from 2023 to 2027

Audio Streaming

Drivers for Today

Earbud shipments continue to rise, leading the market

462 million Bluetooth® earbuds will ship in 2023. By 2027, annual Bluetooth earbud shipments will increase by 54 percent, climbing to 712 million.

56%

of all Bluetooth® wireless headsets shipped in 2023 will be earbuds

Bluetooth® technology is in nearly all speakers

As overall demand and the desire for more flexibility and mobility increases, the adoption of Bluetooth® technology in speakers will also continue to expand. 360 million Bluetooth speakers are expected to ship in 2023.

98%

of all speakers will include Bluetooth® technology in 2023

Audio Streaming

Drivers for Tomorrow

Building on nearly 25 years of innovation, LE Audio enhances the performance of Bluetooth® audio, adds standardized support for hearing aids, and introduces AuracastTM broadcast audio, a new capability that will enable an audio source device (e.g., smartphone, tablet, TV, or public sound systems) to broadcast one or more audio streams to an unlimited number of audio sink devices (e.g., earbuds, speakers, hearing aids, etc). AuracastTM broadcast audio opens significant new opportunities for innovation, including the enablement of personal and location-based audio sharing.

Auracast™ broadcast audio will create new audio experiences

Analysts expect to see significant growth in AuracastTM enabled devices and deployments in public locations over the next five years, driving new experiences, increasing the value of Bluetooth® audio peripherals, and creating new scalability options for assistive listening solutions that open new opportunities for audio accessibility. This growth in AuracastTM deployments will directly impact the speed of adoption for LE Audio devices.

2.5 MILLION

2.5 MILLION

Auracast™ broadcast audio locations will be deployed globally by 2030

LE Audio will deliver enhanced audio performance

LE Audio provides higher audio quality at lower power, enabling audio developers to meet increasing consumer performance demands and driving continuous growth across the audio peripheral market (headsets, earbuds, hearing aids, etc.).

3 BILLION

3 BILLION

LE Audio enabled devices will ship annually by 2027

90%

of new smartphones will support LE Audio by 2027

LE Audio will standardize the implementation for Bluetooth® audio in hearing aids

Industry experts forecast swift adoption of LE Audio in hearing aids. Extending better support for hearing aids and improving satisfaction for those with hearing loss, LE Audio has the potential to provide audio assistance to more than 1.5 billion people with hearing loss today.

2.5 BILLION

2.5 BILLION

people are projected to have some degree of hearing loss by 2050

5.7x INCREASE

in annual shipments of Bluetooth® enabled hearing devices over the next five years

The audio industry welcomes a new, over-the-counter hearing aid market

In August 2022, the U.S. Food and Drug Administration established a category of over-the-counter (OTC) hearing aids. Now, people in the U.S. can directly purchase Bluetooth® enabled OTC hearing aids without a medical exam, audiologist visit, or prescription.

9.5x INCREASE

in annual shipments of Bluetooth® enabled over-the-counter (OTC) hearing devices by 2027

Audio Streaming

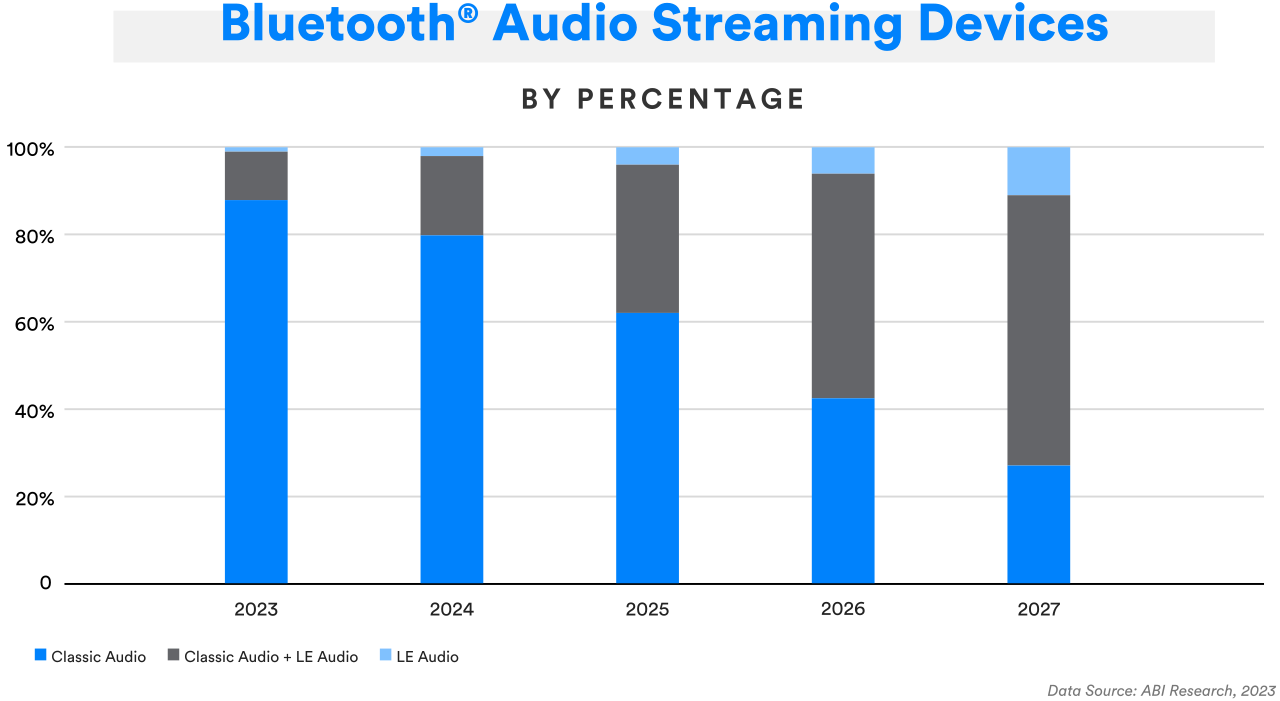

Transitioning to LE Audio

Dual-mode will be the bridge between Bluetooth® Classic Audio and LE Audio

When adopting LE Audio, ecosystem vendors will likely implement different strategies, incorporating the technology into their devices at a varying pace. Throughout this forecast period, most manufacturers will start offering dual-mode audio solutions in order to facilitate the transition. Over time, as the ecosystem matures and new use cases solidify, analyst expect to see a significant increase in standalone LE Audio devices.

LE Audio: The Future of Bluetooth® Audio

Download the report to find out how this evolutionary enhancement to existing Bluetooth® audio capabilities will help establish new use cases and consumer experiences, open the audio ecosystem to new industry players, and enable the Bluetooth audio market to scale to new heights.

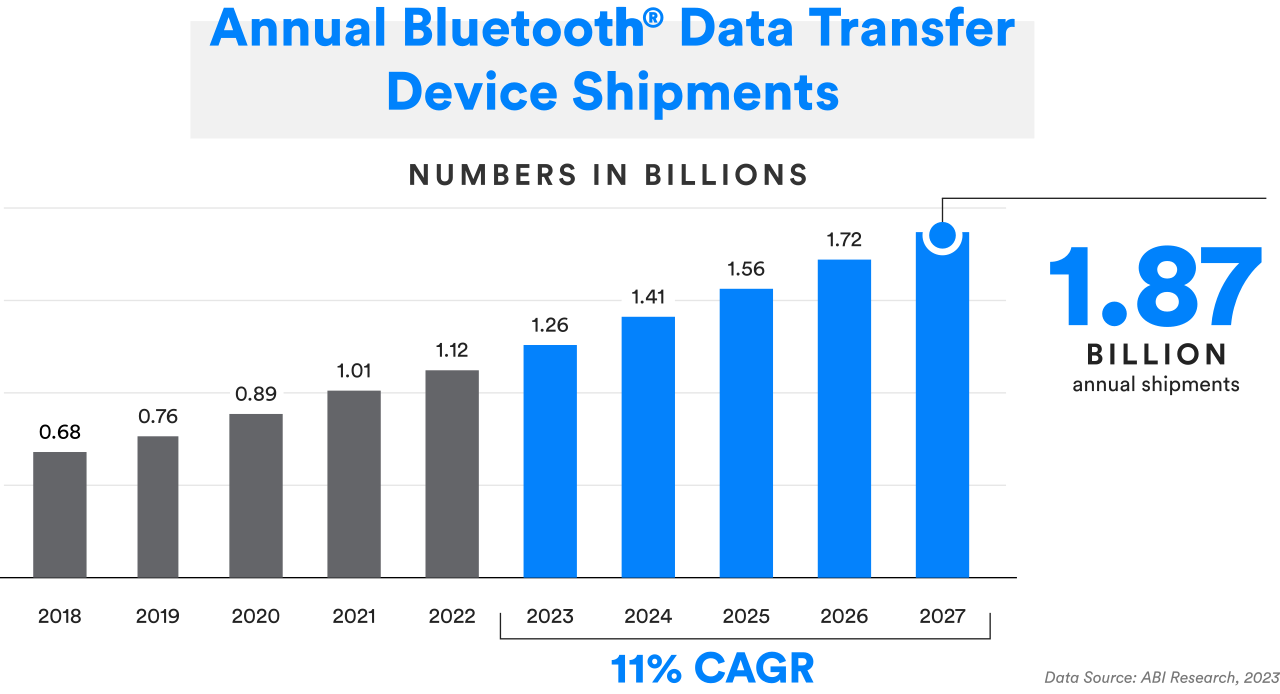

Data Transfer

From fitness trackers and health and wellness monitors to toys and tools, billions of new Bluetooth® low-power, data transfer devices free consumers from wires every day.

Key Use Cases

1.67x GROWTH

in annual Bluetooth® Data Transfer device shipments from 2023 to 2027

Data Transfer

Drivers for Today

Heightened consciousness of health and wellness is driving growth in wearables

The demand for smartwatches and sports, fitness, and wellness trackers is being fueled by increased health awareness, penetration of internet health services post-pandemic, and new technological advancements in health sensors.

143 MILLION

143 MILLION

Bluetooth® smartwatches will ship in 2023

97 MILLION

97 MILLION

Bluetooth® sports, fitness, and wellness trackers will ship in 2023

The consumer entertainment device industry has standardized on Bluetooth® technology for controls

A desire for greater convenience has led to an increased demand for remote controls for products such as TVs, speakers, set top boxes, game consoles, etc.

300 MILLION

300 MILLION

Bluetooth® OEM remote controls will ship in 2023

40 MILLION

40 MILLION

Bluetooth® game controllers will ship in 2023

Continued rise in hybrid work and working from home is driving an increased demand for PC accessories

Bluetooth® PC accessories continue to be in high demand. With a 44 percent increase in remote work over the last five years, more people are using their homes as a combined personal and professional space. This is driving increased need for Bluetooth connected home and peripheral devices.

216 MILLION

216 MILLION

Bluetooth® PC accessories will ship in 2023

44% INCREASE

in remote work over the last 5 years

Data Transfer

Drivers for Tomorrow

Bluetooth® wearables continue to show strong growth

A greater understanding of the personal health benefits provided by Bluetooth® fitness tracking and health monitoring devices is increasing the demand for wearables from people of all ages.

635 MILLION

635 MILLION

Bluetooth® wearables will ship in 2027

Smartwatches continue to lead the wearables category

As smartwatches become more sophisticated, adopting more features and greater functionality, they are not only taking over the role of keeping people connected (e.g., phone, email, text, music, etc.), but also taking over the role of fitness and wellness trackers. There is a strong volume for both categories, with growth shifting to smartwatches. This year, 143 million Bluetooth® smartwatches will ship with that number seeing a 2.4x increase to 290 million annual shipments by 2027.

290 MILLION

290 MILLION

Bluetooth® smartwatches will ship in 2027

Bluetooth® health and wellness wearables experience strong growth

Bluetooth® fitness and wellness trackers will see 12 percent growth in the next five years, increasing from 97 million this year to 106 million annual shipments in 2027. Fitness trackers continue to grow despite the fact that a significant number of smartwatches are taking on this functionality.

106 MILLION

106 MILLION

Bluetooth® fitness and wellness trackers will ship in 2027

Bluetooth® AR/VR devices are set for significant growth

The definition of a wearable continues to expand. Wearables come in many different forms and functions to help deliver and augment other experiences; these include VR headsets for gaming and virtual training, as well as wearable scanners and cameras for industrial manufacturing, warehousing, and asset tracking. Close to 80 million Bluetooth VR headsets will ship annually by 2027.

Smart glasses are being used for navigation, superimposing directional pathways (and other supplemental information) for users to follow. Smart glasses are also being used for train-the-trainer purposes, recording tasks or processes to help educate and provide virtual confirmation of completed tasks. Analysts forecast over 37 million Bluetooth AR smart glasses will ship in 2027.

6x GROWTH

in Bluetooth® VR headsets over the next 5 years

15x GROWTH

in Bluetooth® AR smart glasses from 2023 to 2027

Location Services

Bluetooth® technology is now widely used as a device positioning technology to address the increasing demand for high-accuracy indoor location services. By enabling one Bluetooth device to determine the presence, distance, and direction of another device, Bluetooth technology delivers flexibility unlike any other positioning radio, allowing building managers and owners to scale indoor positioning solutions to match the varying and changing needs of the building.

Key Use Cases

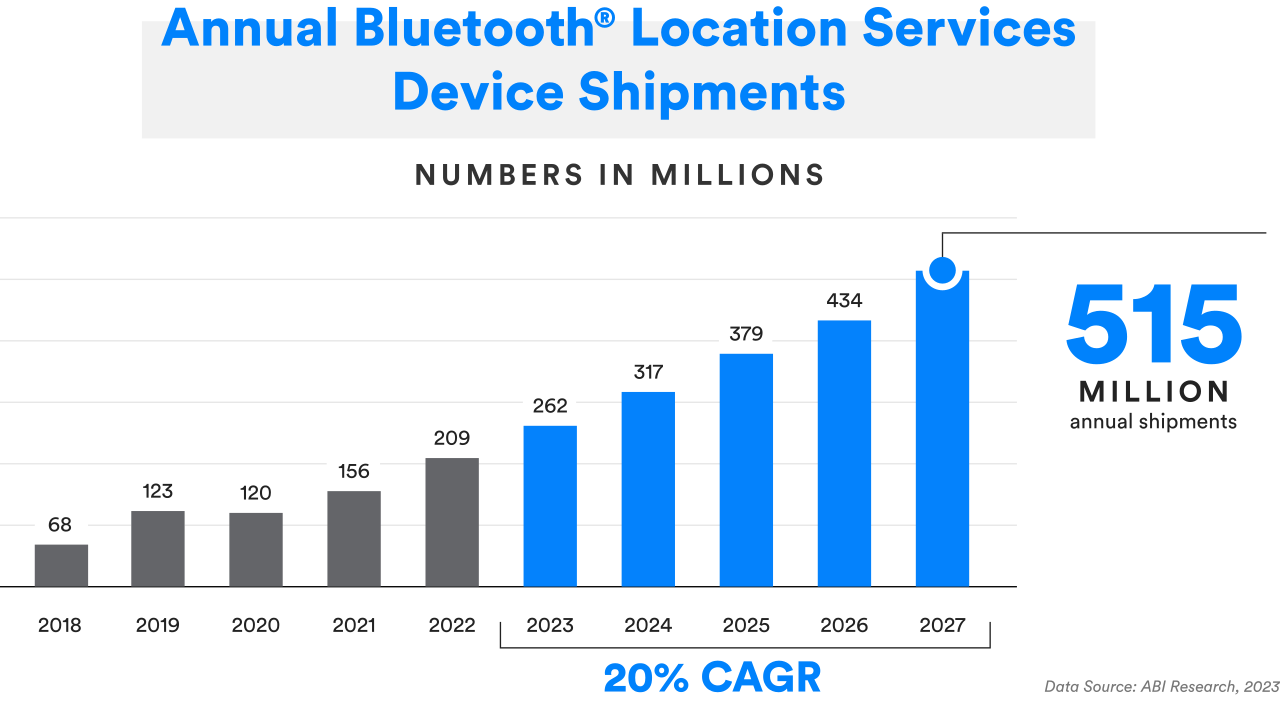

Bluetooth® Location Services device growth will trend significantly upward

Bluetooth® Location Services solutions are expected to return to pre-pandemic forecasts. Heightened awareness of the benefits of Bluetooth Location Services continues to support increased market growth.

2.46x GROWTH

in annual Bluetooth® Location Services device shipments from 2023 to 2027

Location Services

Drivers for Today

Commercial RTLS Solutions

Bluetooth® real-time location systems (RTLS) poised for rapid acceleration

Implementation of Bluetooth® RTLS is seeing significant growth in installations after a recent slowdown caused by COVID-19 and supply chain challenges. This rebound started in 2022 and will continue through the five-year forecast period. New regulatory safety requirements in manufacturing, more stringent compliance procedures, and sustainable operation measures are making RTLS solutions more viable than ever before.

178 THOUSAND

178 THOUSAND

total Bluetooth® RTLS implementations by the end of 2023

Swift expansion of Bluetooth® commercial asset tracking solutions is driving Bluetooth Location Services growth

More commercial and industrial facilities are turning to Bluetooth® asset tracking solutions to optimize resource and inventory control. Analysts conclude that, among Bluetooth Location Services devices, asset tracking anchor points and tags are major drivers behind continued growth.

112 MILLION

112 MILLION

Bluetooth® asset tracking devices will ship in 2023

Consumer Item Finding Solutions

Annual shipments for personal item finding solutions continue to grow

Higher accuracy and increased demand for personal item finding and device tracking solutions are driving wider use of Bluetooth® item finding innovations, resulting in a 2x growth in annual shipments by 2027.

97 MILLION

97 MILLION

personal Bluetooth® item finding solutions will ship in 2023

Access Control Solutions

Bluetooth® technology is playing an important role in automotive access control

Increasing recognition and acceptance of digital keys are driving demand for more access and control capabilities in smartphones. Bluetooth® based fobs not only lock and unlock doors but also bring more convenience to drivers.

31 MILLION

31 MILLION

Bluetooth® key fobs and accessories will ship in 2023

Leading automotive vendors now support smartphone digital key capabilities

Building on the success of the key fob, Bluetooth® technology in the smartphone can help securely access automobiles while limiting the number of devices that need to be carried. Having achieved 100 percent penetration in smartphones, Bluetooth technology is uniquely positioned to meet this demand.

100%

of new smartphones include Bluetooth® digital key-enabling technology

Location Services

Drivers for Tomorrow

Bluetooth® high-accuracy distance measurement will set a new bar for performance of location services solutions

Bluetooth® technology will soon add high-accuracy distance measurement (HADM), enabling item finding solutions to provide greater precision as users get closer to an item being located, allowing passive keyless entry solutions to add another layer of authentication and accuracy, and improving the performance of real-time locating systems.

260 MILLION

260 MILLION

Bluetooth® asset tracking devices will ship in 2027

338 THOUSAND

338 THOUSAND

Bluetooth® RTLS implementations by 2027

Ambient IoT has the potential to disrupt market forecasts

A new class of very low-cost tags is enabling a whole new category of Bluetooth® tracking solutions being referred to as the Ambient IoT. With a total addressable market of more than 10 trillion devices across different verticals, Ambient IoT solutions will significantly improve supply chains with an early focus on high-velocity chains that support expiring goods, such as food, medicine, and returnable assets. Its ubiquity and mature ecosystem, combined with its capability to support low-cost devices for tags and receivers, best positions Bluetooth technology to maximize the benefits of the Ambient IoT.

10 TRILLION

10 TRILLION

total addressable market for Ambient IoT devices

Device Networks

Bluetooth® Device Network solutions in home, commercial, or other environments can reliably and securely connect tens, hundreds, or thousands of devices within a network.

Key Use Cases

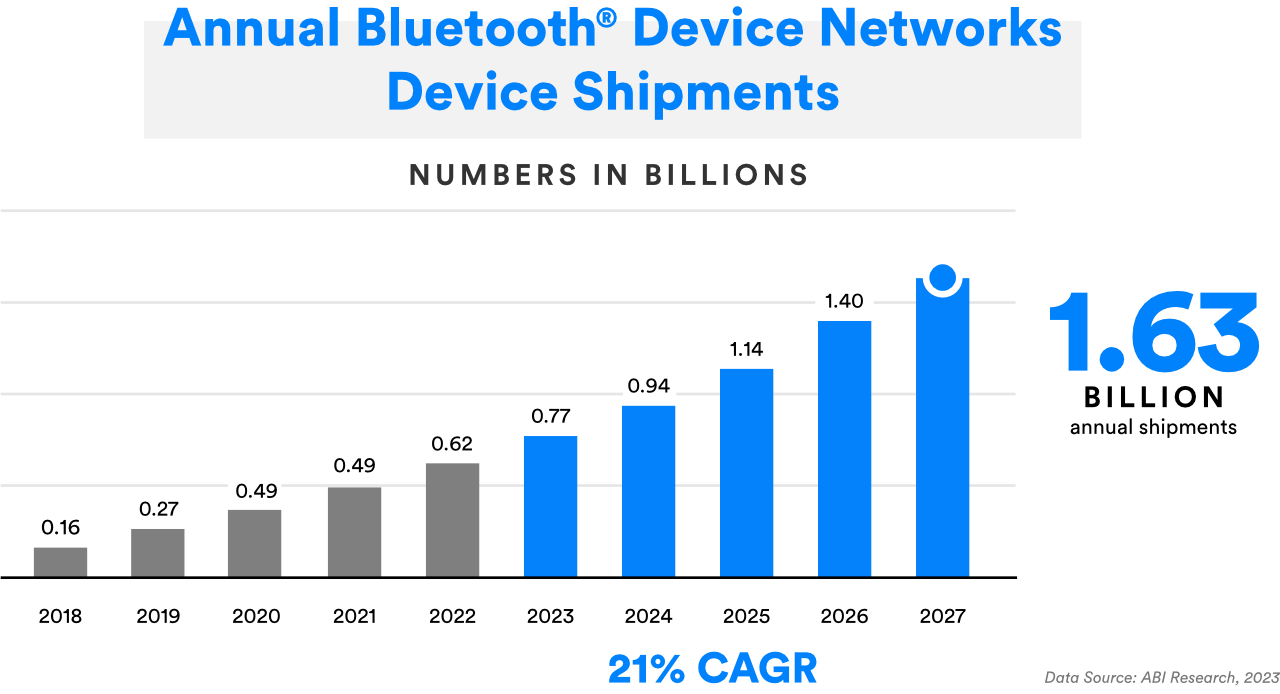

2.63x GROWTH

in annual Bluetooth® Device Network device shipments from 2023 to 2027

Device Networks

Drivers for Today

Smart home devices continue to play a significant role in the market

Today, Bluetooth® technology is the radio of choice for commissioning in all smart home devices, making it the dominant radio in the smart home. Now, with its inclusion in the Matter standard, the role of Bluetooth technology in the smart home will remain unrivaled for years to come.

686 MILLION

686 MILLION

Bluetooth® smart home devices will ship in 2023

Greater connectivity in the smart home market is leading to a significant increase in smart appliances

Bluetooth® technology established itself as the go-to technology in many smart home solutions and is now expanding its role in home IoT. Air purifiers and conditioners and countertop appliance markets saw the greatest growth, tripling in shipments over previous forecasts.

165 MILLION

165 MILLION

Bluetooth® smart appliances will ship in 2023

Device Networks

Drivers for Tomorrow

Networked Lighting Control

Bluetooth® networked lighting control is experiencing mainstream traction

The proliferation of LEDs, a desire for greater energy efficiency, faster deployment capabilities, and a higher-quality occupant experience are driving the demand for Bluetooth® commercial networked lighting control solutions.

115% CAGR

of Bluetooth® networked lighting control devices over the next five years

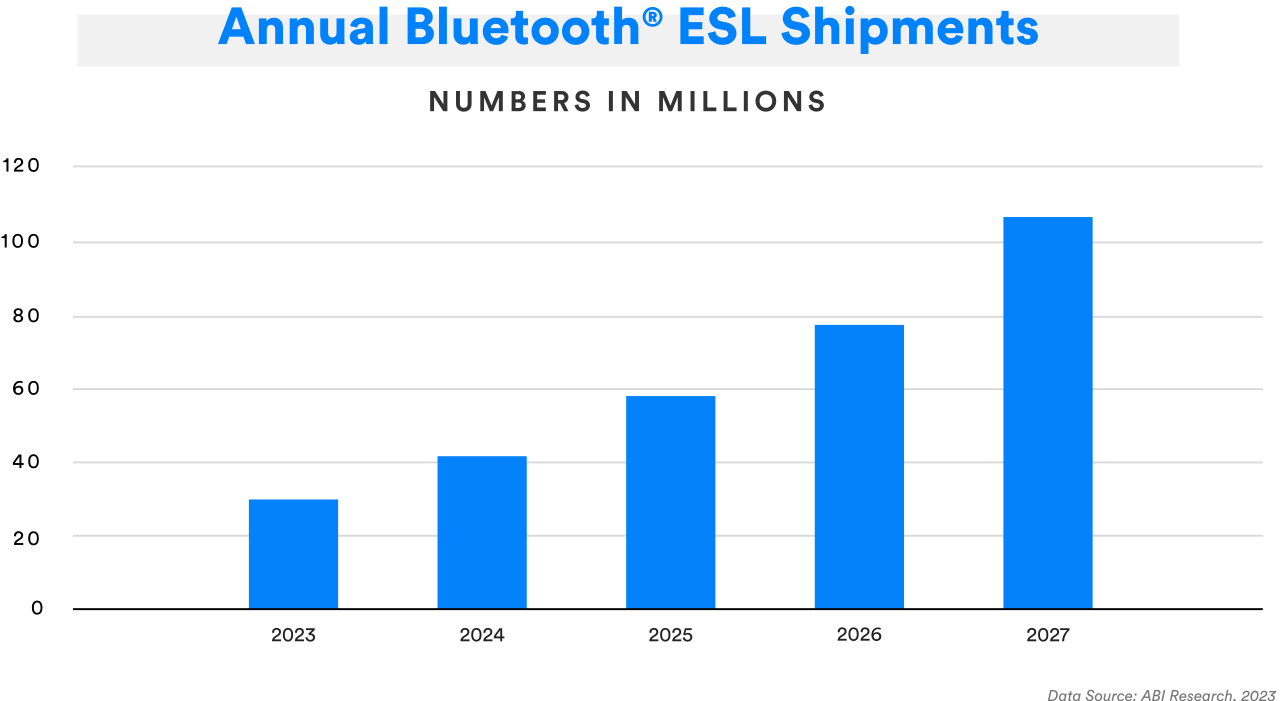

Electronic Shelf Labels

Electronic shelf labels emerge as a new, high-volume market

Electronic shelf labels (ESL) provide always-accurate pricing, increased access to real-time promotions and product information, and a more gratifying and cohesive omnichannel experience. For retailers, they can streamline picking and fulfillment for click and collect shoppers while also accelerating shelf replenishments to optimize product availability on shelves and avoid missed sales.

334 MILLION

334 MILLION

Bluetooth® electronic shelf label devices will ship by 2027

“Retailers are increasingly looking towards IoT technologies to help deliver operational efficiencies, increase conversion, and to encourage customers to return to stores in the post-COVID-19 landscape.”

Andrew Zignani, ABI Research

CONDITION MONITORING

Bluetooth® condition monitoring is driving greater sensorization

Machines and equipment used in the manufacturing processes are already being monitored by large networks of wireless sensors, and more vendors in industrial settings are increasingly looking to maximize condition monitoring benefits, such as preventive and predictive maintenance that can help avoid costly repairs. Analysts anticipate seeing a long tail of use cases within this segment as more companies leverage a wide range of condition monitoring solutions.

32 MILLION

32 MILLION

Bluetooth® condition monitoring solutions will be implemented by 2026

Join the Bluetooth Market Research Community

Receive early access to the latest Bluetooth® market trends and forecasts and weigh in on what data is collected and shared to ensure you receive the research that's most valuable to you and your business.